Caring Community of Learners: Professional Expectations

Throughout this course and throughout the remainder of your degree program you will study strategies aimed at making your center, school, program or classroom an effective learning environment for those children in your care. While there are many pieces to this puzzle, one of the keys to being effective is creating a caring community of learners. This community is where both children and adults alike “engage in warm, positive relationships, trust each other with respect, and learn from and with each other” (Bredekamp, 2017, p. 240). The research connecting effective classrooms and schools/centers to a caring community of learners is strong, which is why this discussion is so important.

To prepare for this discussion, read chapters 5 and 8 of the Bredekamp text, view The Pyramid Model. (Links to an external site.)

For your initial post:

- Analyze why, according to Bredekamp (2017) “Teachers today report that more children are exhibiting challenging behaviors than in the past” (p. 241). Why do you feel this might be true? What factors account for this perception?

- Describe the relationship between behavior, self-concept, self-esteem and self-efficacy. How are they interconnected?

- Explain how your understanding of this interconnectedness helps you more effectively create a caring community of learners. Provide at least two examples and support your explanation with your text and at least one scholarly resource (Links to an external site.).

- Propose at least one strategy you will use in your classroom, school or center that incorporates each of the four levels on The Teaching Pyramid (figure 8.1). Support this portion of your discussion with your text.

These are the notes:

Pyramid Components

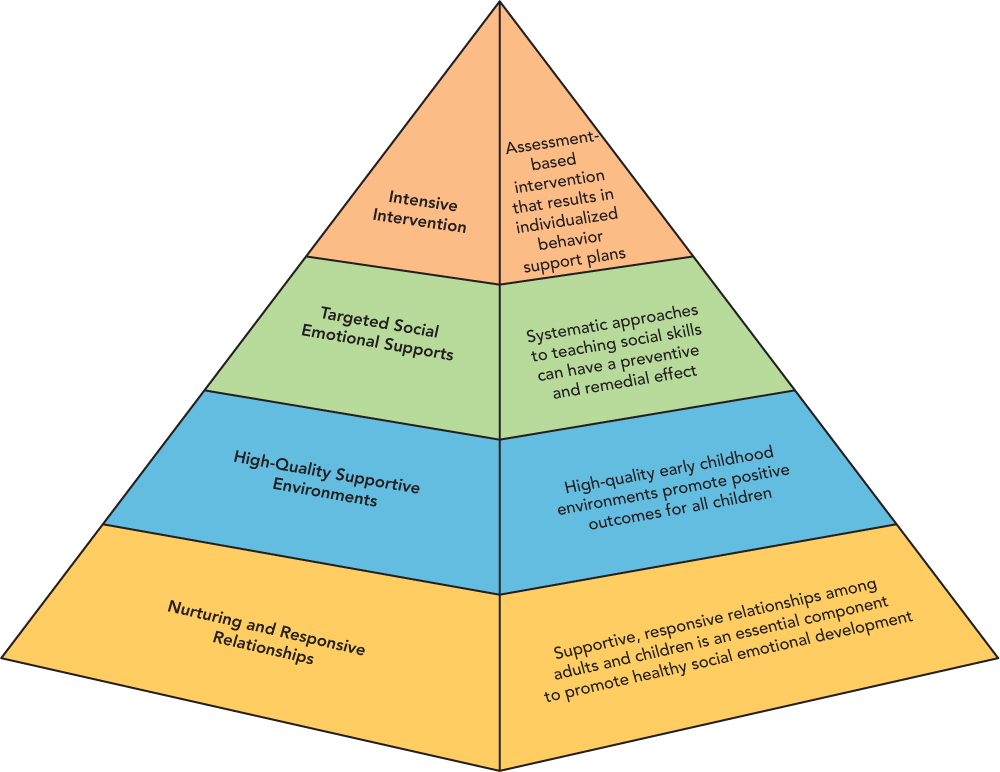

The Teaching Pyramid is composed of four parts: (1) positive relationships with children, (2) high-quality supportive environments, (3) social and emotional teaching strategies, and (4) intensive individualized interventions. The base of the pyramid is the largest portion because it represents the foundation of positive relationships on which everything else depends. Each subsequent topic on the pyramid builds on the ones below, and represents a proportionately smaller amount of teachers’ time and effort. This model indicates that if teachers effectively provide these supports, children will learn social competence, their positive behaviors will increase and challenging behaviors will diminish.

When teachers encounter children who exhibit negative behaviors such as aggression or hostility, their first inclination is to try to “fix” that child. As teachers, we naturally assume that if we could just quickly change that child’s behavior, everything would be well and our job would be so much easier. The truth is that there are no quick fixes; in fact, the more effective strategy is not to try to fix the child at first. It is always more difficult to change another person’s behavior, even if that person is only 3 years old, than to change our own behavior.

The Teaching Pyramid turns our prior assumptions on their head. Rather than trying to change children first, we begin by changing ourselves—that is, we examine our behavior in order to focus on establishing a positive relationship with each child. We recognize that more difficult children will take more effort, but we also acknowledge that the effort will pay off greatly. Next, we evaluate teaching environments and routines and determine what changes need to be made to support children’s positive behavior. How can we support routines that help children do their best? How can we teach social skills and emotional self-regulation? By asking these questions and exploring solutions, we attempt to directly address individual children’s challenging behaviors.

FIGURE 8.1 Teaching Pyramid Model for Promoting Children’s Social and Emotional Competence

The Teaching Pyramid is a research-based, effective framework to help teachers support children’s social-emotional learning and reduce challenging behaviors in the classroom. Source: From Promoting Social and Emotional Competence in Infants and Young Children. The Center on the Social and Emotional Foundations for Early Learning, http://csefel.vanderbilt.edu. Reprinted by permission.

Source: From Promoting Social and Emotional Competence in Infants and Young Children. The Center on the Social and Emotional Foundations for Early Learning, http://csefel.vanderbilt.edu. Reprinted by permission.

The Pyramid’s Effectiveness

Research demonstrates that when teachers consistently apply the strategies described in the Pyramid Model, positive social interactions among children increase and behavior problems decrease (Hemmeter, Snyder, Fox, & Algina, 2011). Research suggests that fewer than 4% of children require the more intensive level of interventions (Fox, Dunlap, Hemmeter, Joseph, & Strain, 2003). In a group of 20 children, that equates to only one child. In a center serving 100 children, about 4 children might require this level of intensive assistance. In the following sections, we discuss each level of the Teaching Pyramid and provide examples of effective teaching practices.